Narrow-minded isn’t a term most of us find endearing. But, when considering how employers can get control of their unmanageable healthcare costs, it may give us a hint to one evolving approach.

In recent years, there has been an explosion of new healthcare plan products, vendors, and solutions attempting to address the problem of unsustainable health plan cost increases. Many project savings of 20+ percent for employers’ health plan expenses.

This has led some employers to consider the significant step of incorporating narrow networks as a part of their benefit plan offerings.

If you’re an employer reading this, first, keep breathing. It’s OK. I understand that the idea of limiting provider choice in a tight job market is scary. Our country’s healthcare system has evolved into one where members expect to see any provider for any reason without permission or restriction. So, let’s look at the reality of what it means to incorporate a narrow network offering and different ways to do it.

What is a Narrow Network?

But first, what do we mean by narrow network? Effectively, it’s any network that has eliminated one or more hospitals, groups of providers, or healthcare systems. The decisions around which healthcare providers are included or excluded can vary. Possibly the most impactful network curation currently evolving is based on quality.

Until recently, a lack of healthcare transparency has made it difficult to account for the impact of quality on healthcare expenses. However, there has been an increase in available data (e.g., Medicare Quality Payment Program) and a surge in third-party companies mining healthcare data.

Additionally, the federal requirement for healthcare providers and health plans to publish contracted reimbursement rates by provider and procedure through machine-readable files (MRFs) has facilitated more granular analysis demonstrating meaningful connections and actionable outcomes. And, of course, our new friend artificial intelligence (AI) is on the scene helping the data engineers analyze more data and do it faster.

Is Costly Higher Quality Healthcare Worth It?

With the cost and quality data now available, it begs the question — is paying for higher quality worth it? It’s actually a trick question.

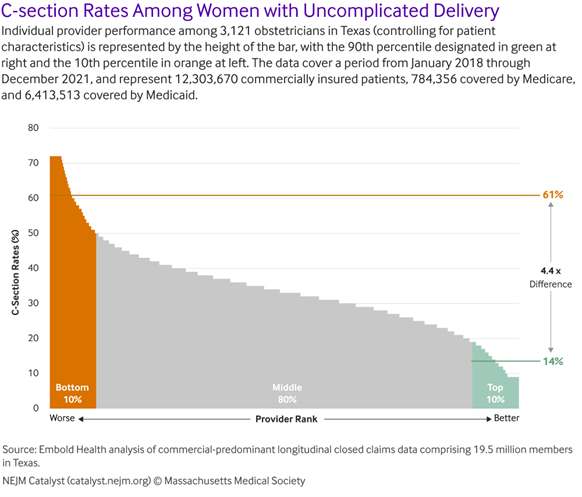

In aggregate, there is an inverse relationship between quality and cost. That is, higher quality providers ultimately provide better care at a lower overall expense. A recent New England of Medicine Journal article, “The Role of Employers in Addressing Quality Variation in Employer-Sponsored Health Insurance”, illustrates the point. It cites studies showing better outcomes and lower costs when accessing top-quality providers for procedures, such as c-section deliveries (see graph in the article) and conditions like statin adherence for patients with stable coronary artery disease.

What shouldn’t get lost in this financial consideration is the actual outcomes themselves to the patient and the impact on their quality of life, which has still further ramifications.

Very large employers (e.g., Walmart) can leverage their massive healthcare spend to require providers to incorporate quality into the contracts based on metrics and outcomes. Small-to- mid-size employers generally do not have that type of leverage.

So how can they benefit from the quality data available? The answer is through accessing high-performance and value-based networks. The key is ensuring that the vendors and solutions they are accessing incorporate quality as a key criteria in determining the network of providers.

Consider Offering Multiple Healthcare Offering Approaches

It is also important to understand that employers don’t necessarily need to jump into the deep end of the disruption pool by eliminating access to the broad panel of providers that their employees enjoy, expect, and possibly require. Full replacement approaches that only offer narrow networks represent the greatest opportunity for savings and improved outcomes, but also introduce the greatest amount of disruption.

Employers can consider a hybrid approach offering a narrow network solution side-by-side with a broad network option that allows members to select which option fits them best, but also sets contributions that reflect their decision. Want broad access with no consideration for provider quality? It costs more. Willing to accept a smaller panel of high-quality providers? You pay a reduced contribution and/or enjoy richer benefits.

Is Healthcare Benefit Tiering an Option?

Still another approach involves the use of quality data layered onto a broad network to create benefit tiering rather than hard steerage. This can feel like a “virtual narrow network” in that the network providers themselves are all similarly contracted, but quality designations provided by third-party solutions effectively create a high performing tier inside the broad network.

We Have Experts Who Can Help!

The best decision for you, your company, and your employees depends on culture, cost, and tolerance for disruption. But for those willing to evolve their company health plans to help steer employees and their dependents to quality providers, there are solutions in the market that are ready to help get you there.

Holmes Murphy is passionate about making our clients better and partnering with each other to understand and navigate these dynamic times and we’re happy to help you out. Please don’t hesitate to reach out to us. Our goal is to ensure you’re covered and informed!