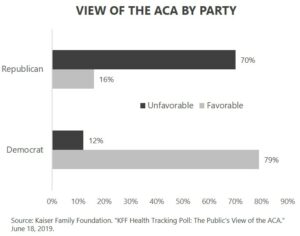

The Affordable Care Act is sometimes referred to as healthcare reform, but it is really health insurance reform. Public opinions on the ACA are split along party lines. The majority of Democrats have a positive opinion of the law, and the majority of Republicans maintain a negative perception of Obamacare.

Opinions regarding the ACA have not changed much over time. According to a Kaiser Family Foundation survey, 46 percent of Americans held a generally favorable view of the ACA one month after its signing in April 2010, while 40 percent held a negative view. Nine years later, the generally favorable polling results have not changed — 46 percent view it favorably, and 40 percent are generally negative.

My sense is those on the right feel the ACA is a form of government overreach that has made healthcare more complicated and more expensive, but they probably lack the specific details to support their opinion. My sense is those on the left feel the ACA expanded coverage and beat up the insurance companies for their profit-motivated denial of coverage and care. They probably also lack specific details to support their opinions. I understand that opinions fall along party lines, but I wonder how folks on either side would answer, “So what exactly did the Affordable Care Act do that makes you like or dislike it so much?”

This topic, and my upcoming book for that matter, likely will not have any impact on your like or dislike of the ACA. However, it is vitally important for voters to understand exactly what the ACA did and did not do and how it was or was not funded. Repealing, repairing, or replacing the ACA makes no sense if you don’t know exactly what you are trying to fix.

I describe the ACA’s biggest impact in the form of a three-ring circus. I don’t do this because I think the ACA is a circus, but it’s an easy way for me to help communicate the three distinct and specific outcomes of the ACA.

- Reformed insurance rules. The ACA completely changed the pricing and underwriting rules for individual and small group coverage. Insurance companies can no longer use gender in underwriting. The cost difference between young adults and older adults was compressed. Underwriting based on individual healthcare status was outlawed, so full preexisting condition protection applied in all coverage. Insurance companies had to refund plan participants a portion of their premium if a specified percentage of total cost wasn’t spent on claims. Plan designs in the individual market had to align with one of four metallic plan designs. Annual and lifetime benefit maximums were eliminated. The rules of the insurance business were completely rewritten by the ACA into a heavily regulated market.

- Decreased the number of uninsured Americans. The ACA decreased the number of uninsured Americans by expanding Medicaid eligibility, creating a subsidized system for individual insurance, mandating that individuals purchase health insurance or pay a penalty to the IRS, and mandating that large employers offer health insurance to their employees. The result of the ACA coverage expansion is that the number of uninsured Americans has dropped from an estimated forty-five million in 2009 to thirty-three million in 2017, according to the U.S. Census Bureau.

- Sustained Medicare. The ACA’s impact on Medicare isn’t frequently discussed. The ACA added new Medicare taxes and reduced scheduled payments to hospitals, home healthcare, and skilled nursing facilities. The combination of new revenue and decreased expenses increased the lifespan for the Medicare Hospital Insurance Trust Fund. The 2009 Medicare Trustee Report, in the year prior to the passage of the ACA, projected that the Medicare Hospital Insurance Trust Fund would be exhausted in 2017. The Medicare Hospital Insurance Trust Fund has remained solvent past the 2017 forecast, and the 2019 Medicare Trustee Report projects the fund will remain solvent until 2026. In effect, the ACA Medicare reimbursement reductions and new taxes added nine years to Medicare’s solvency. The changes were not a permanent solution, but they did provide temporary relief to Medicare’s financial stress. The reimbursement reductions were primarily targeted at hospital and skilled nursing facilities. The new taxes were primarily aimed at investment income and the wealthy.

The ACA decreased the number of uninsured Americans, but it came up well short of providing universal health coverage. Medicare delayed its Hospital Insurance Trust Fund insolvency, but the long-term Medicare funding challenges remain very relevant. The health insurance industry operates under a very different set of rules now than prior to the ACA, but health insurance remains the most complicated consumer industry in the world, and health insurance inflation has continued to outpace general inflation or earnings.

Exchange, Marketplace, and Subsidies

The ACA created a regulated individual insurance program for federally subsidized health insurance that was initially called the Exchange. It is now officially named the Health Insurance Marketplace. The terms exchange, marketplace, and Obamacare are sometimes used to describe the same regulated and subsidized individual health insurance marketplace. By 2018, the number of people purchasing subsidized coverage through the Health Insurance Marketplace had grown to over 9.7 million. Actual enrollment was less than half of the predicted 24 million by 2018 from the Congressional Budget Office (CBO) when the law was passed in 2010.

The ACA created a subsidy system based on income. Subsidies are available for individuals in households with income between 100 and 400 percent of the federal poverty level (FPL) who are not eligible for Medicaid or for affordable employer-sponsored health insurance. The percentage of income required for baseline coverage begins at 2.08 percent of household income at the bottom end of the scale and rises up to 9.86 percent at or above 250 percent of FPL. In 2019, 400 percent of FPL is $49,960 for a single-person household and $103,000 for a family of four.

An individual cannot choose between Medicaid, employer coverage, or subsidized Marketplace coverage. Eligibility for either Medicaid or affordable employer coverage disqualifies the individual for a subsidy. “Affordable” means 9.86 percent of household income for single coverage within an employer-sponsored plan. There is no affordability measurement for family coverage. Family members can get stuck with high-cost coverage through a spouse or parent but not be eligible for a subsidy because the employee-only coverage option is deemed affordable. In other words, affordable employee-only coverage can disqualify the rest of the family for a subsidy in the ACA Marketplace.

The subsidy amount is determined based on the cost of a benchmark plan, but the Marketplace allows the participant to use their subsidy to purchase any plan available. The average per-person annual subsidy in 2018 was $6,600.

What Does the ACA Cost Taxpayers?

Short answer: $1.9 trillion. The CBO scored the cost of the ACA when it was passed and continued to track its coverage and cost impact into 2017. The ACA has now been integrated into the broader review of federal government spending on healthcare, so there are no longer dedicated budget estimates of the ACA. The CBO uses a 10-year economic-impact cost basis. The final CBO estimate from the January 2017 report is a cost of $998 billion for Medicaid expansion and $919 billion for the subsidized Marketplace system created by the ACA, for a total coverage expansion cost of over $1.9 trillion.

The ACA expanded coverage to approximately 20 million people. Rounding the cost to $2 trillion over a 10-year period equates to an annual approximate health insurance expansion cost of $10,000 per covered person per year.

How Is (and Is Not) the ACA Funded?

The largest source of funding for the ACA was from Medicare. The combination of Medicare provider reimbursement reductions and the Medicare taxes provided Medicare with a temporary reprieve from its ominous financial position. This temporary reduction in the Medicare shortfall provided budget room to add new programs. You may be asking yourself, “Wait. Medicare is going to need all the revenue and savings it can get. How can the new ACA programs get their funding from Medicare?” Your question would be a valid one. Although the original ACA scoring gave the ACA the dollars from Medicare savings, the programs are now financed separately, and there really are no Medicare savings available to fund ACA coverage expansion.

The second area of funding was new industry fees charged to the pharmaceutical, medical device, health insurance, and tanning booth industries. They are referred to as fees, rather than taxes, because the fees are not linked to or contingent upon profit. They are applied based on market share. These industry fees have created significant pushback from the industries impacted, who say that the fees simply increase the cost for consumers. With annual moratoriums, the industry fees have been sporadically applied.

The third area of funding was related to mandates and penalties. Large employers, defined as having at least 50 full-time employees, were required to offer health insurance to their full-time employees or to make a shared-responsibility payment for not offering coverage. In a similar fashion, every American is required by the ACA to have health insurance coverage. Those who chose to not have coverage were subject to a shared-responsibility payment. The shared-responsibility payment for individuals was lowered to zero by the Trump administration and Republican Congress. The law still requires every American to have health insurance, but there is no financial penalty for noncompliance. The large-employer, shared-responsibility payment implementation was delayed but is still in place.

Two major funding sources have never been implemented. A program known as the Cadillac tax was intended to create a 40 percent surcharge, or tax, on high-value health plans. High value was really just high cost, because the tax would apply to plans above a specified total cost threshold and had no direct connection with the actual value of a plan design. The Cadillac tax is one thing in Washington, DC, that actually brings Republicans and Democrats together. Both think the Cadillac tax is a bad idea. The House of Representatives voted 419-6 to repeal the Cadillac tax in July 2019. The repeal of the tax is estimated to cost the government over $196 billion. It appears Republicans and Democrats can also agree that increasing the deficit is easier than confronting healthcare’s cost and funding challenges.

The other unimplemented area of funding was a government-created, long-term care program called CLASS. Actuarial analysis of the program showed the plan was not financially viable. It was quietly killed before it ever became a reality.

The ACA funding sources created, implemented, and that survived total less than $.4 trillion in true funding. This is less than 20 cents of revenue to cover every dollar of new federal government expense for the ACA coverage expansions. The net result is an unfunded expense of $1.5 trillion according to the CBO’s latest calculation.

What About Trumpcare?

President Donald Trump campaigned on the promise to repeal and replace Obamacare, but he left the task of developing and defining the replacement to Republican Representatives and Senators. Republicans, and President Trump, failed at their attempts to repeal the ACA despite having control of the House of Representatives, Senate, and the White House. I have never viewed healthcare as a top priority for the Trump administration, but there has been meaningful activity that I can define as Trumpcare.

- Elimination of the individual mandate — The Trump administration was not successful in repealing the ACA and its mandate that individuals must have health insurance; however, they were able to make the penalty for not having coverage $0. Meaning, it’s still federal law that Americans must have health insurance, but the penalty is $0. Trump supporters view this action positively as a removal of a government over-reach policy, and Trump detractors view it negatively because it’s expected to increase the number of Americans who do not have health insurance.

- Stabilization of Obamacare cost and choice — The Trump administration de-funded plan design subsidy payments to insurance companies in the Marketplace. Insurance companies raised premiums for everyone to make up for the federal government failure on their promise to pay. The result is that the insurance industry has become profitable in Obamacare with stable rates and increasing choice. President Trump’s action inadvertently brought price and choice stability to the Obamacare Marketplace.

- Choice — The Trump administration has attempted to bring more choice to health insurance. Regulatory support of association health plans was attempted but has had legal and market challenges. I believe the single biggest healthcare creation of the Trump administration is the creation of the Individual Coverage Health Reimbursement Arrangement (ICHRA). ICHRA allows an employer to put pre-tax money into an account that allows employees to purchase any health insurance coverage they desire. An employer no longer has to offer an employer-sponsored health plan, and the employee can purchase any individual plan on or off the Marketplace, or even a faith-based health sharing program. It is truly the individual’s choice. Health insurance can move from employer-controlled to simply employer-funded with ICHRA. In a piece of legislative irony, ICHRA is essentially an expansion of a program created by the Obama administration for small business.

- Transparency — The Trump administration has taken meaningful steps to bring transparency to the pharmaceutical industry pricing and hospital pricing. These efforts have been met with legal and advertising resistance from pharmaceutical and hospital industry lobbying groups.

ACA Recap

- ACA public opinion is split along party lines.

- The ACA reformed insurance, extended Medicare solvency, and reduced the number of uninsured Americans by approximately 20 million people.

- The ACA subsidies cover an average of 86 percent of the total health insurance premium cost.

- Revenue sources dedicated to funding the ACA coverage expansions cover less than 20 percent of the cost.

What’s Next?

Almost 10 years after its passing, the ACA is still a mystery to most Americans, and their opinions of it seem to be based more on politics than an understanding of its true costs and benefits. The reality is that it doesn’t truly satisfy those on the left or the right. The Republicans failed in their attempts to repeal and replace. Expect Democrats to be the next to try to replace the ACA with something that gets closer to the social justice goal of universal health insurance. Major legislation takes major effort and major control. Unless a future election creates a partisan clean sweep, it appears fixing the ACA seems a more likely path than repeal from the right or replacement from the left.

Whew…that was a lot. I know. And, of course, as with healthcare, nothing is simple. So, I’d love to know your thoughts, answer any questions you might have, etc. Let me know!

Next week, I’ll take a look at the individual insurance market basics and what it means to you. Be sure to tune in. And, if you haven’t already, I encourage you to sign up for our “Insiders’ Club” where you’ll be notified when I release new information AND receive a FREE copy of my book “The Voter’s Guide to Healthcare: A non-partisan, candid, and relevant look at politics and healthcare in America” when it’s available.