For employers reading this, I have a question. Have you received a shocking renewal increase on your employee medical health plan?

Here is a typical scenario playing out in today’s market. Claims are running reasonably well, and you have an 85% loss ratio. Large claims don’t have anything too scary, at least from your perspective. You’re expecting a 10% renewal increase but are really hoping for something under 6%. And then, you get a 20% increase on your renewal proposal. Whoa!

And now I have a second question – why were you surprised?

Let’s look at three drivers of the current employee medical health plan renewal increases. Two are driving the price of healthcare and one is driving utilization.

Delayed Healthcare Inflation

America is still recovering from the effects of the COVID pandemic and its impact on healthcare costs. We’ve all read stories about the strain on healthcare workers and subsequent influence on professionals leaving the field following the worst of the crisis. Who can blame them? They were working exhausting hours watching many of their patients lose their lives in an environment of political turmoil.

Those that remained in the field saw the appreciation and value of their services increase dramatically. Compensation began to adjust correspondingly and appropriately. As a result, hospital costs increased.

Sure, you say, I’ve read about this in the last couple of years. But I have had two renewals since then and both were manageable. Why is this having such an impact in 2024?

Part of the answer is that hospitals, providers, and carriers don’t renegotiate reimbursement agreements every year. Many hospital system renegotiations are on three-year cycles. So, the increases in labor costs that happened in 2021 and 2022 are just now being realized in higher carrier reimbursements to hospitals and providers. This is part of what is driving the highest healthcare trend increases since Congress passed the Patient Protection and Affordable Care Act (PPACA), also known as Obamacare. These increases in reimbursements translate into higher healthcare trend and larger insurance premiums.

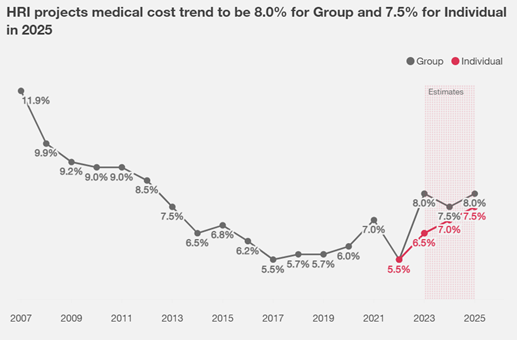

Here is a look at healthcare trend over the past 17 years:

This doesn’t mean that nursing compensation increases are entirely responsible for your 20% renewal. We’re not laying all of this at their hardworking feet. My mother was a nurse and I know better than that!

Healthcare Provider Consolidation

Another contributing dynamic is hospital and specialty provider practice consolidation leading to reduced competition and higher healthcare prices. On the positive side, some research has shown that consolidation can lead to greater care coordination and quality of care. It has not, however, led to lower costs for patients and employer health plans.

Private equity has also played an expanding role as it has increased merger and acquisition activity in healthcare with a frequent focus on short-term profitability.

Pharmacy Spend Driven by New Utilization

Another factor that is also a significant cost driver beyond hospitals and provider offices has emerged – dramatic increases in glucagon-like peptide 1 (GLP-1) agonists utilization.

40% of GLP-1 users have taken the drug specifically for weight loss. As these medications move from injectable to oral therapies, this segment will continue to grow and employers covering these drugs will see additional GLP-1 users.

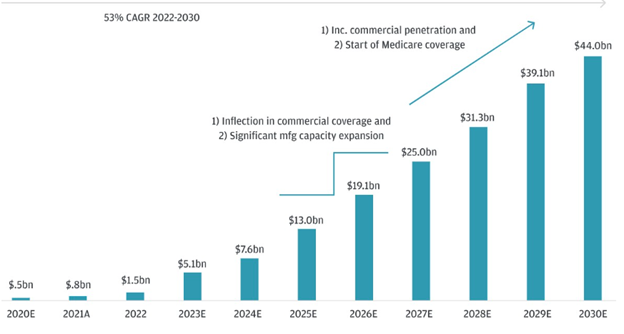

J.P. Morgan Research forecasts that the GLP-1 category will reach $44 billion in 2030 specifically related to weight loss as shown in this chart:

There is Hope for This Year’s Renewal

For employers, COVID-era pressure to retain employees led to a status quo movement. No major health plan changes – just hang on and power through. With the trends now happening in the healthcare cost environment, the status quo may no longer be affordable.

Fortunately, there are more creative options than ever before for plan sponsors to find cost savings and identify high quality providers. Some are wholesale plan changes while others are precision programs. The best solutions can help provide options to deal with your surprise renewal. Combining these solutions, the Employee Benefits team at Holmes Murphy has reduced healthcare trend increases for our book of business to 4%, or about half of the national average.

Ready to learn more about reducing your healthcare costs? We’re here to help. Contact us today and let’s start a conversation!